Unknown Facts About Special Loan Programs Available for Home Buyers in Nevada

What Does Down Payment Options - BallenVegas.com Do?

With a lot of costs included (think closing expenses, long-term loans, mortgages, and deposits) a house for you and your household may appear like a castle in the air in this economy. I Found This Interesting do not quit! Even if you're having a hard time financially, there are different homebuyer assistance programs in Nevada all set to assist dedicated individuals like you.

Let's check out the finest programs for first-time property buyers in Nevada. The primary step, as always, is due diligence. You'll desire to investigate your choices and educate yourself as much as possible. For beginners, consider studying government websites such as HUD.GOV for precise information regarding homeownership assistance in Nevada, consisting of statewide and regional programs offered to eligible people.

Additionally, it is necessary to learn more about the buying procedure, particularly for first-time property buyers. An excellent place to start is Cash Smart an FDIC monetary education program developed to help individuals of any ages hone their financial abilities and develop positive banking relationships. This can be extremely beneficial to newbie property buyers requesting a loan.

Home Is Possible - Nevada down payment assistance

HIP For First-Time Homebuyers - NEVADA HOUSING DIVISION

MAF Widget Feeling excellent about your background understanding? All set to explore the grant programs and property buyer programs available to novice Nevada house purchasers? Let's get into it! Here are the programs you ought to understand about: For newbie property buyers in Nevada, a down payment help program called "House Is Possible" can be an indispensable resource.

First-time Home Buyer Information, Tools and Resources

The Only Guide to Take Advantage of These 5 First-Time Homebuyer Programs

This money can be found in the type of a fixed rates of interest 30-year loan for as much as 5 percent of the overall mortgage worth. In other words, if you're taking out a $150K home mortgage, this program could help you secure approximately $7,500 for your down payment and closing costs.

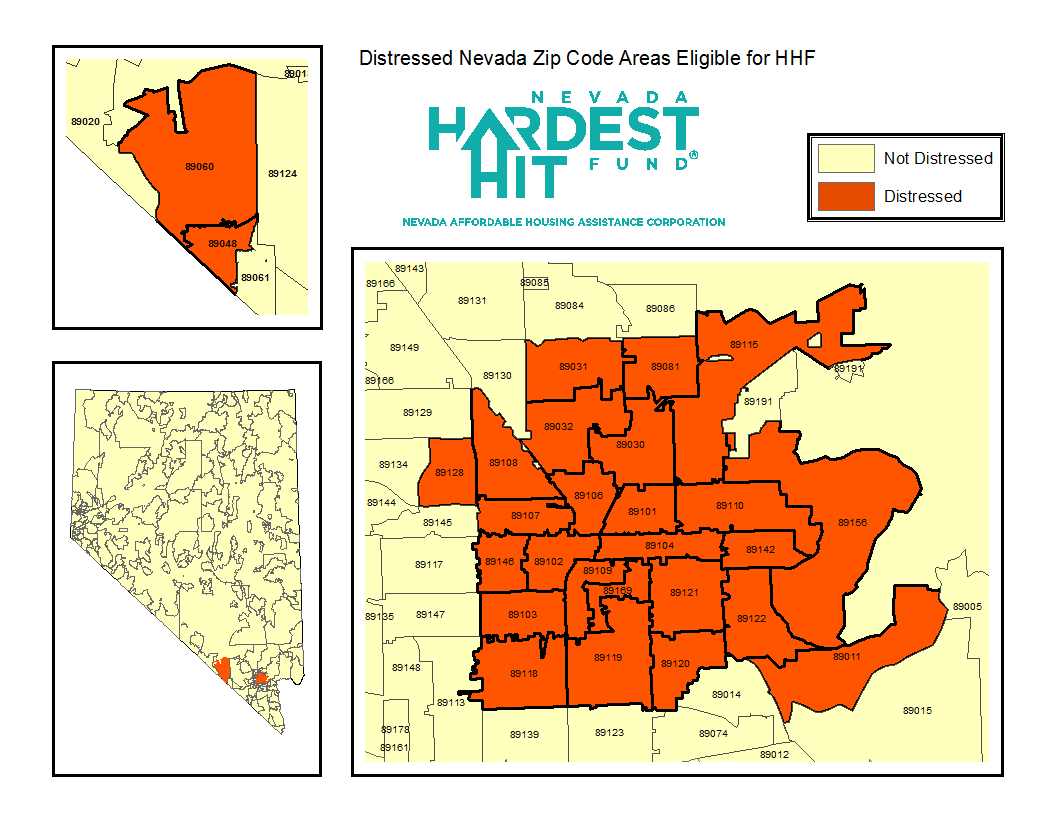

Available to homeowners throughout the state of Nevada as a fixed-rate mortgage with a 30-year term, The loan can be as high as 5 percent of the house's total loan quantity. It must go straight towards expenses connected with the house's closing and down payment, A minimum credit history of 640 is required, Your household's annual income should be less than $98,500 and the house cost must be less than $510,400 You should finish a property buyer education courseThe Home Is Possible program likewise works in tandem with the Home loan Credit Certificate (MCC) program used through the Nevada Real estate Division For extra borrower and property eligibility requirements, click here.